Master convertible bond valuation and analysis. Learn conversion ratios, pricing models, warrants, preferred stock, and hybrid security structures.

Choose your expertise level to adjust how many terms are explained. Beginners see more tooltips, experts see fewer to maintain reading flow. Hover over underlined terms for instant definitions.

Convertible Bonds and Hybrid Securities

Convertible bonds occupy a middle ground in financial markets. They are neither pure debt nor pure equity, but rather a hybrid that combines features of both. A convertible bond is a corporate bond that grants you the right to exchange the bond for a predetermined number of shares of the issuing company's common stock. This embedded conversion feature fundamentally changes the risk-return profile compared to a straight bond, creating a security that behaves differently depending on where the underlying stock price trades relative to the conversion price.

Why would a company issue such an instrument? Consider a growth company that needs capital but faces a dilemma: issuing straight debt means high interest payments due to the company's risk profile, while issuing equity dilutes existing shareholders at what management believes is an undervalued stock price. A convertible bond offers a middle path. The conversion feature is valuable to investors, so they accept a lower coupon rate than they would demand for straight debt. Meanwhile, if the stock price rises and you convert, the company effectively issues equity at a price higher than today's market price. This creates a win-win scenario: investors get the option value they desire, while the company reduces its immediate financing costs and potentially issues equity at more favorable terms in the future.

For investors, convertible bonds offer an asymmetric payoff profile that appeals to those seeking a particular balance of risk and reward. If the stock performs well, the convertible participates in the upside through conversion. If the stock performs poorly, the bond floor provides downside protection. You still receive your coupon payments and principal at maturity, assuming the company remains solvent. This "equity upside with bond downside protection" makes convertibles attractive to investors who want exposure to a company's growth potential while limiting downside risk. Understanding how these two forces interact is the key to understanding convertible bond valuation and behavior.

Anatomy of a Convertible Bond

A convertible bond combines the characteristics of a traditional fixed-income instrument with an embedded equity call option. Understanding the key terms is essential for analyzing these securities. Before valuing a convertible or assessing its risk, we must understand the terminology used to describe its structure.

Core Components

The conversion ratio specifies how many shares of common stock you receive upon conversion. This ratio establishes the fundamental link between the bond and the underlying equity. For example, a convertible bond with a conversion ratio of 25 means the holder can exchange each bond for 25 shares. This ratio is typically fixed at issuance, though anti-dilution provisions may adjust it for stock splits, stock dividends, or other corporate actions that affect the share count. The conversion ratio is critical in convertible analysis because it determines your equity exposure.

The conversion price is the effective price per share you pay when converting. This metric allows you to quickly assess whether conversion makes economic sense by comparing it to the current stock price. The conversion price is calculated as follows:

where:

- : the face value of the bond, typically $1,000

- : the number of shares received for each bond converted

For example, with $1,000 par value and a conversion ratio of 25, the conversion price is $40 per share. This is typically set 20-30% above the stock price at issuance, creating an initial conversion premium. This premium means the stock must appreciate meaningfully before conversion becomes immediately profitable, which is intentional: it compensates the issuer for giving away the valuable conversion option and gives the company time to grow into a higher stock price.

The conversion value (also called parity) represents what the bond would be worth if converted immediately. This is the equity component of the convertible's value and fluctuates directly with the underlying stock price. The conversion value provides a real-time measure of how much equity value is embedded in the convertible:

where:

- : the fixed number of shares received per bond

- : the market price of the underlying equity

For example, if the stock trades at $45 and the conversion ratio is 25, the conversion value is $1,125. This represents the equity component's current worth. When the conversion value exceeds the straight bond value by a significant margin, the convertible is said to be "in the money" and will behave more like the underlying equity. Conversely, when the conversion value is well below the bond floor, the convertible is "out of the money" and will behave more like a traditional bond.

The straight bond value (or investment value) is what the bond would be worth without the conversion feature: simply the present value of its coupon payments and principal, discounted at an appropriate yield for the issuer's credit risk. This value represents the floor below which the convertible theoretically should not trade, since at that point the bond's fixed-income characteristics alone would justify its price. As we discussed in the chapter on Bond Fundamentals and Pricing, calculating this value requires selecting an appropriate discount rate reflecting the issuer's credit spread over risk-free rates. The straight bond value anchors the convertible's downside, providing the "bond floor" protection that makes these securities attractive to risk-conscious investors. We can implement these component calculations in Python to determine the theoretical floor values and premiums:

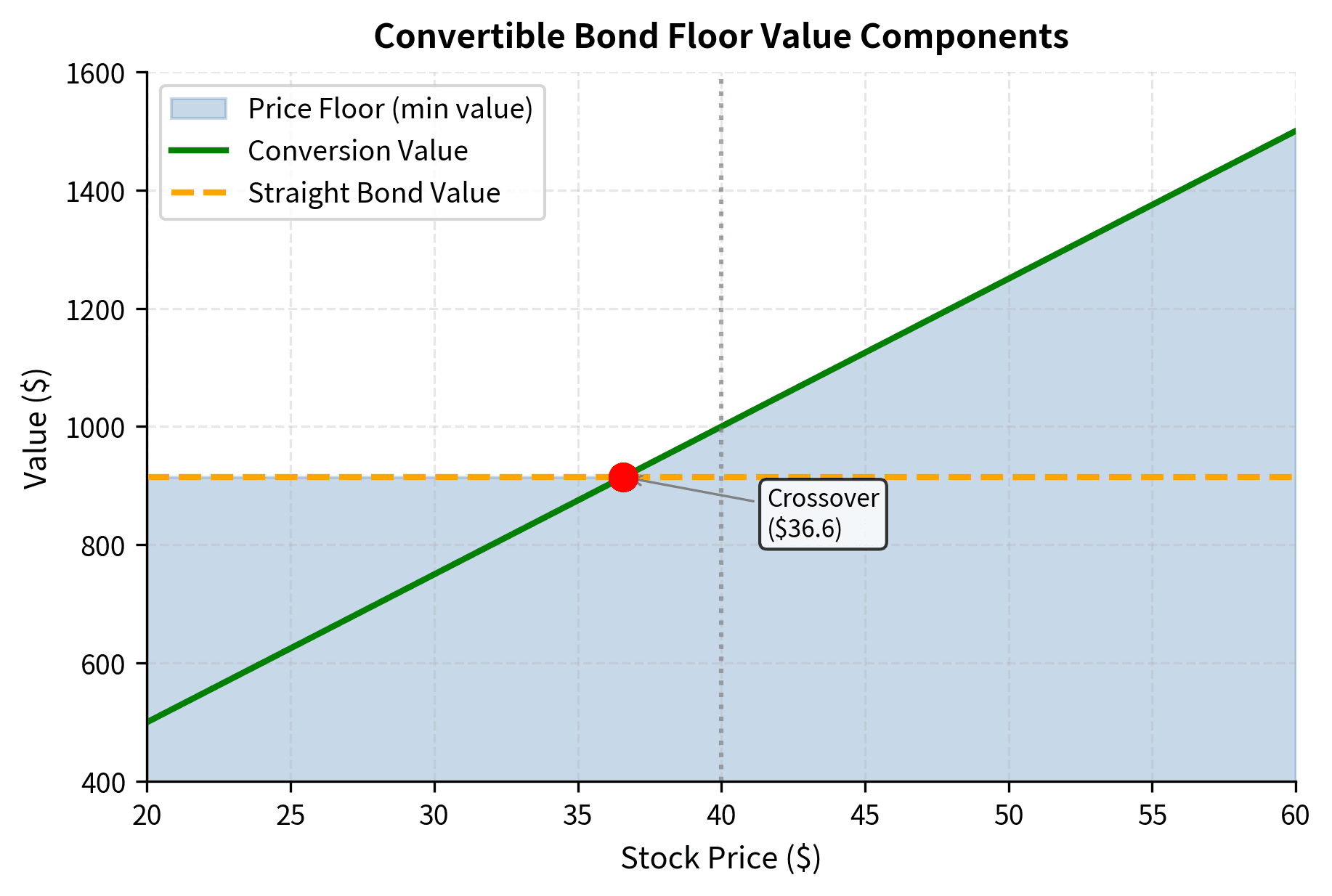

The conversion premium of $5.00 (14.3%) tells us the stock must rise from $35 to $40 before conversion becomes immediately profitable. The straight bond value of $914.70 represents the "floor" value if the conversion option becomes worthless. These two values, the conversion value and the straight bond value, establish the boundaries within which we can understand the convertible's behavior.

The Convertible Bond Price

The market price of a convertible bond is bounded below by two values, each representing a different source of value within the hybrid security:

-

Conversion value: If the bond traded below this, arbitrageurs would buy the bond, convert immediately, and sell the shares for a risk-free profit. This arbitrage mechanism ensures the convertible cannot trade significantly below its conversion value for any sustained period.

-

Straight bond value: If the bond traded below this, investors would buy it purely for its bond characteristics, ignoring the conversion option. The stream of coupon payments and the return of principal at maturity would make the bond attractive to fixed-income investors even without any equity upside.

We can express this floor mathematically as follows:

where:

- : the market price of the convertible bond

- : the value of the bond if converted immediately

- : the value of the bond as a pure fixed-income instrument

This inequality tells us that the convertible will always trade at or above whichever component value is larger. The convertible typically trades above this floor because the conversion option has time value. Even if conversion isn't profitable today, it might become profitable before maturity. The possibility of future stock price appreciation adds value to the option, and this value is reflected in the convertible's market price.

The figure illustrates how a convertible bond's price profile changes with the underlying stock price, revealing the hybrid nature of the security in visual form. When the stock trades well below the conversion price, the convertible behaves like a bond; its price stays near the straight bond value and is relatively insensitive to stock movements. In this region, the conversion option is deeply out of the money, and the convertible's value derives primarily from its fixed-income characteristics. As the stock rises toward and above the conversion price, the convertible increasingly behaves like equity, with its price tracking the conversion value more closely. In this equity-like region, small movements in the stock price translate almost directly into movements in the convertible price. The shaded area represents the option's time value, which is largest when the stock is near the conversion price (at-the-money) and diminishes as it moves deep in or out of the money. This pattern reflects the fundamental principle of option pricing: uncertainty about where the option will finish at expiration creates the most value when the underlying is near the strike price.

Valuation Approaches

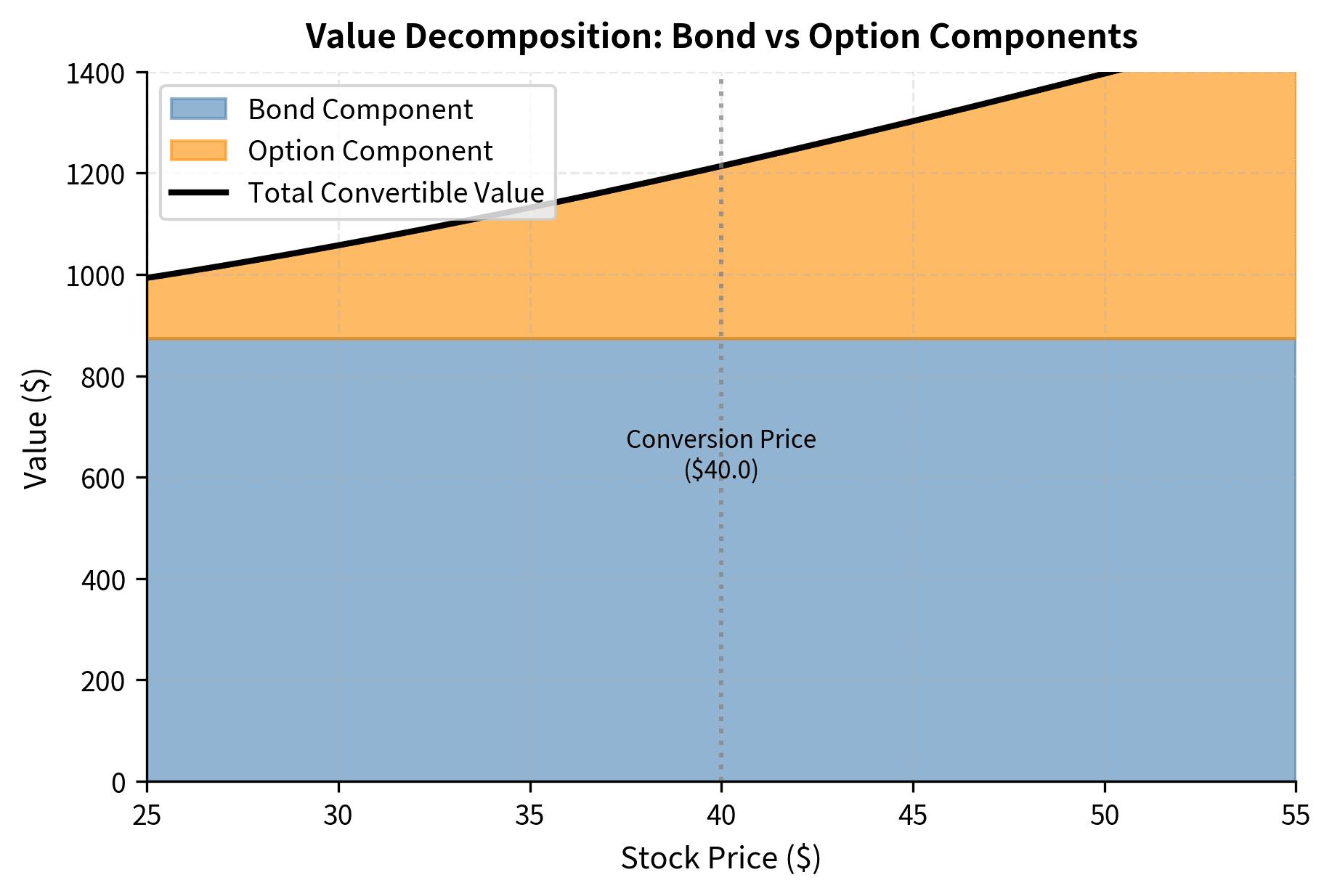

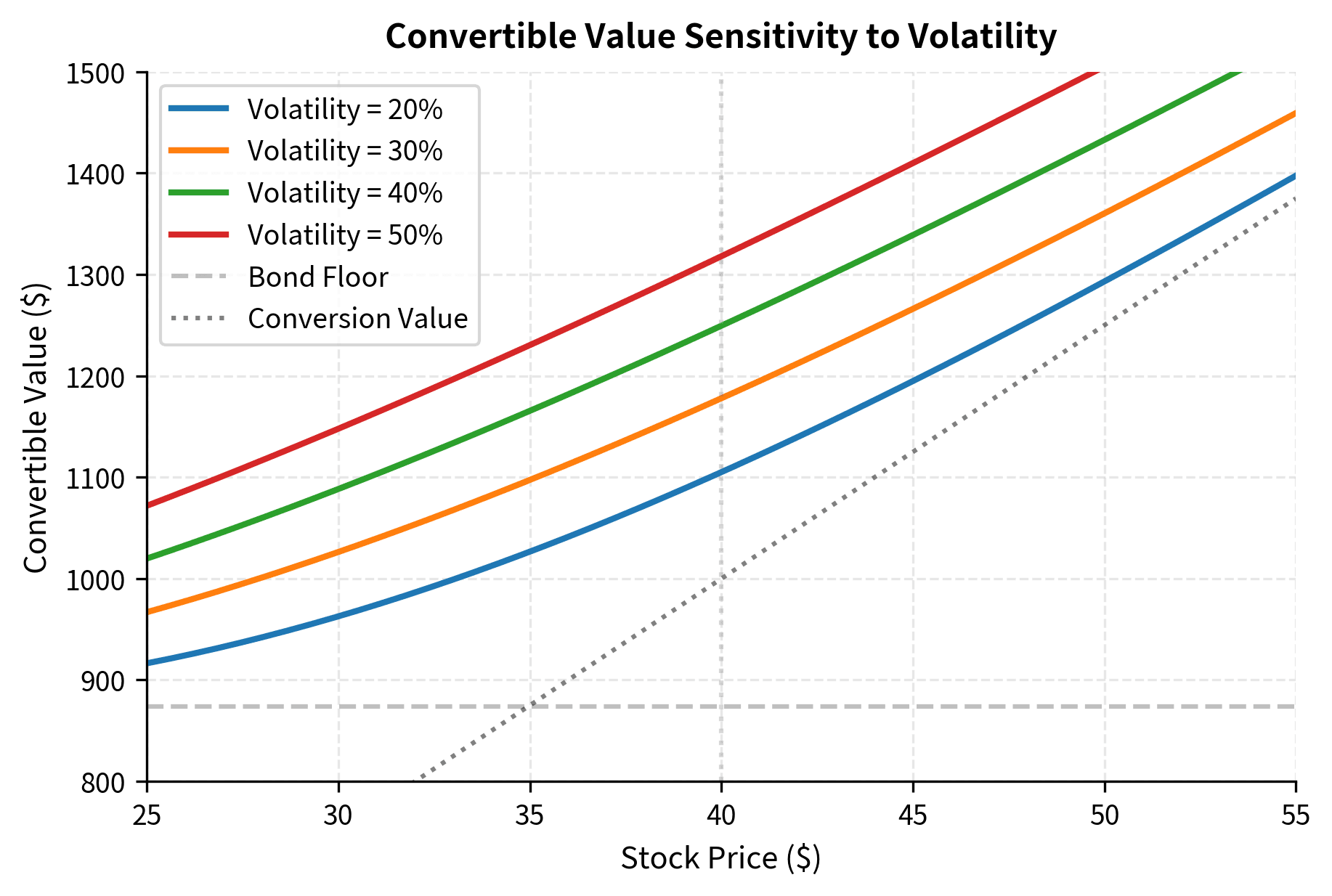

Valuing convertible bonds is more complex than valuing straight bonds or plain vanilla options because convertibles combine features of both, with interactions between interest rate risk, credit risk, and equity risk. The valuation challenge lies not just in modeling each component separately, but in understanding how they interact with each other. We can decompose the value into its constituent parts:

where:

- : the theoretical fair value of the hybrid security

- : the present value of coupon and principal payments discounted at the risky rate

- : the value of the right to exchange the bond for stock

This decomposition provides a useful framework for thinking about where value comes from in a convertible bond. The bond component provides steady income and return of principal, while the option component provides the upside participation. However, this decomposition is complicated by several factors that make real-world implementation more challenging than the simple formula suggests. The call option isn't a standard exchange-traded option. It has a long maturity (often 5-10 years), the strike price effectively equals the straight bond value (which fluctuates with interest rates and credit spreads), and the option can typically be exercised at any time (American-style). Additionally, if the company defaults, both the bond and the option become worthless, creating correlation between the components that the simple additive model ignores.

Simple Component-Based Valuation

For a rough estimate that provides intuition about convertible valuation, we can value the components separately and add them together. This approach treats the convertible as a portfolio containing a bond and a specified number of call options:

where:

- : present value of the bond's coupon and principal payments

- : number of shares received upon conversion

- Call Option Value: theoretical value of an option to buy one share at the conversion price

The logic behind this formula is straightforward: you effectively own a bond plus the right to convert that bond into shares. The right to convert into shares is economically similar to owning call options on the stock, with the conversion price serving as the strike price. The total number of options is equal to the conversion ratio, since that's how many shares you can acquire. We can implement this component-based valuation in Python, using the Black-Scholes model for the option component:

This simple model suggests the convertible should trade around $1,101 with roughly 17% of its value coming from the embedded option. The conversion premium of 15.9% indicates the convertible trades above its current conversion value due to the time value of the option and the bond floor protection. These results provide a useful starting point for analysis, though you should recognize the limitations discussed below.

Limitations of Simple Valuation

The component-based approach has important limitations. While the model provides intuition, several real-world complications can cause market prices to diverge from its predictions.

Credit-equity correlation: If the stock price falls dramatically, credit risk typically increases, pushing down the straight bond value. The simple model treats these as independent, but they are closely linked. When a company approaches distress, both the bond floor and option value decline simultaneously, providing less downside protection than the model suggests. This correlation is perhaps the most significant limitation of the simple model, as it overstates the protection the bond floor provides.

Callable convertibles: Most convertibles are callable by the issuer, allowing the company to force conversion by calling the bond when the conversion value exceeds the call price. This caps the upside for you and requires more sophisticated models to value. The call feature transfers value from you to shareholders, reducing the theoretical value of the convertible relative to a non-callable structure.

Variable interest rates: The straight bond value changes as interest rates move, affecting the option's effective strike price. The components interact in complex ways that the simple additive model cannot capture. When rates rise, the bond floor falls, which can actually increase the relative importance of the option component in determining the convertible's price.

For accurate valuation, you use models that jointly model stock price dynamics and credit risk, such as binomial trees adapted for convertibles or Monte Carlo simulations with correlated credit and equity factors. We'll explore more sophisticated pricing techniques in Part III when we cover option pricing models in detail.

Key Parameters

The key parameters for the convertible bond valuation model are:

- Par Value: The face value of the bond, typically $1,000 paid at maturity. This serves as the numerator in calculating the conversion price.

- Conversion Ratio: Number of shares received per bond. Determines the conversion price and establishes the fundamental link between the bond and equity.

- S: Current stock price. Higher stock prices increase the value of the embedded option and the conversion value.

- r: Risk-free rate. Used to discount cash flows and value the option component.

- Credit Spread: The yield premium over the risk-free rate reflecting the issuer's default risk. Higher spreads reduce the straight bond value.

- σ: Volatility of the underlying stock. Higher volatility increases the value of the conversion option because it raises the probability of large upside moves.

- T: Time to maturity. Affects both the present value of bond payments and the option's time value, with longer maturities generally increasing option value.

Analyzing a Convertible Bond Position

Let's examine how a convertible bond behaves across different market scenarios to understand its risk-return characteristics. By modeling various outcomes for the underlying stock, we can see how the convertible's hybrid nature manifests in practice. This scenario analysis illuminates why convertibles appeal to you if you seek a particular risk-return profile.

The scenario analysis reveals the asymmetric payoff profile of convertibles, which is the defining characteristic that makes these instruments attractive to many investors. When the stock crashes 50%, the convertible bond limits losses to about 5% (thanks to the bond floor plus coupon income), compared to the stock's 50% loss. The bond floor provides substantial downside protection, transforming what would be a devastating loss into a modest one. However, when the stock doubles, the convertible captures most of the upside, returning about 87% versus the stock's 100%. This "participate in gains, cushion the losses" characteristic makes convertibles attractive for risk-conscious investors seeking equity exposure. The tradeoff is clear: you give up some upside potential in exchange for significant downside protection.

The bar chart visually reinforces the convertible's asymmetric profile, making the risk-return tradeoff immediately apparent. In the "Stock crashes" scenario, the convertible's loss is minimal compared to the stock's plunge, while in the "Stock doubles" scenario, the convertible captures nearly all of the upside return. Notice how the difference between the two bars narrows as we move from left to right across the scenarios. In the crash scenario, the convertible dramatically outperforms the stock, but in the double scenario, the stock marginally outperforms the convertible. This visual pattern encapsulates the essence of convertible bond investing.

Measures of Convertible Bond Risk and Return

You use several metrics to evaluate convertible bonds and compare them across issuers. These measures help you assess whether a particular convertible offers an attractive risk-return profile and how sensitive the position is to various market factors. Understanding these metrics is essential for you to make informed investment decisions in the convertible bond market.

Conversion Premium

The conversion premium measures how much more you pay for the convertible compared to its immediate conversion value. This metric captures how far "out of the money" the conversion option is and provides insight into how the convertible will behave relative to the underlying stock:

where:

- : current market price of the convertible bond

- : current market value of the shares the bond converts into

A higher premium means greater downside protection (the bond floor is more relevant) but less equity sensitivity. The convertible will track the stock price less closely when the premium is high. Lower premium convertibles behave more like equity, with their prices moving nearly one-for-one with the underlying stock. Typical premiums at issuance range from 20-35%, though premiums can expand or contract over time as the stock price moves and as market conditions change.

Premium Payback Period

The premium payback period estimates how long it takes for the convertible's income advantage over the stock (through higher yield) to recover the conversion premium. This metric helps you assess whether the premium is justified by comparing the extra cost of the convertible to the extra income it provides:

where:

- : the extra cost paid for the convertible relative to the stock, expressed per share

- : annual coupon income attributable to each share of the conversion ratio

- : annual dividend income from one share of common stock

This metric helps you assess whether the premium is justified by the income advantage. A shorter payback period suggests the income advantage will quickly compensate for the premium paid, while a longer payback period means investors must wait longer before the extra income offsets the higher entry cost. This metric is most useful when comparing convertibles on the same underlying stock or when deciding between a convertible and direct stock ownership.

Delta and Equity Sensitivity

The delta of a convertible measures how much its price changes for a $1 change in the underlying stock. Delta captures the convertible's equity sensitivity and is one of the most important risk measures for convertible investors and traders:

where:

- : the sensitivity of the convertible bond's price to changes in the stock price

- : the change in the convertible bond price

- : the small change in the underlying stock price

A delta of 0.6 means the convertible price rises approximately $0.60 for each $1 increase in the stock. Delta ranges from near zero (deep out-of-the-money, bond-like) to near the conversion ratio (deep in-the-money, equity-like). Understanding delta is crucial for hedging and for understanding how the convertible will behave in different market conditions. You, for example, use delta to determine how many shares to short against your convertible long positions.

The metrics tell us that this convertible trades at a 14.2% premium to conversion value, meaning investors are paying more for the convertible than they would for the equivalent shares. The 3.69% current yield exceeds the income from owning the underlying shares directly, and this yield advantage would recover the conversion premium in about 5.7 years. For the conversion to be immediately profitable, the stock would need to rise 14.2% to $43.40. These metrics collectively paint a picture of a convertible that offers meaningful income while waiting for potential equity appreciation.

Key Parameters

The key parameters for convertible bond metrics are:

- Conversion Premium: The percentage by which the convertible price exceeds the conversion value. Higher premiums indicate more bond-like behavior.

- Payback Period: The time required for the yield advantage to recover the conversion premium. Shorter periods suggest better value.

- Delta (): The sensitivity of the convertible price to changes in the stock price. Ranges from near zero (bond-like) to near the conversion ratio (equity-like).

- Yield Advantage: The difference between the convertible's coupon yield and the stock's dividend yield. This income differential is what compensates for the conversion premium.

Other Hybrid Securities

Convertible bonds are the most common hybrid security, but financial engineering has produced numerous other instruments that combine debt, equity, and derivative characteristics. Each of these securities addresses specific needs of issuers or investors, and understanding them broadens our appreciation of how hybrid structures can be designed to achieve particular objectives.

Warrants

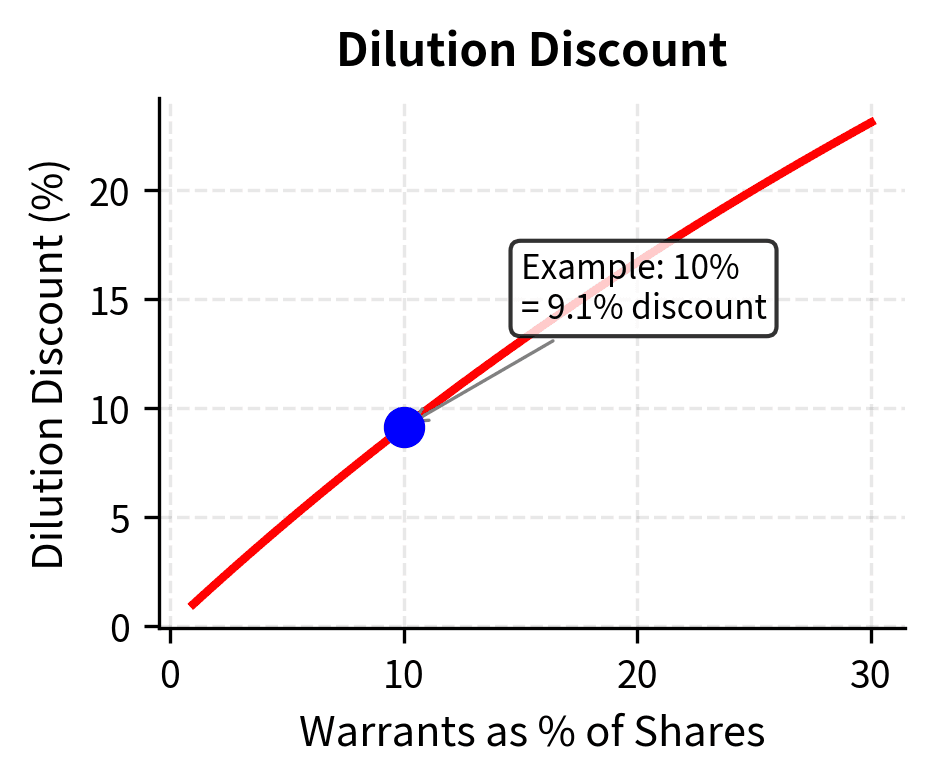

A warrant is a long-dated call option issued by a company on its own stock. Unlike exchange-traded options, warrants are issued directly by the company and, when exercised, create new shares that dilute existing shareholders. This dilution effect is the key difference between warrants and standard options, and it must be accounted for in valuation. Key differences from standard options include:

- Dilution: Exercise creates new shares, increasing shares outstanding and reducing the per-share value of existing equity

- Longer maturity: Often 3-10 years, compared to options' typical 1-2 years

- Issuer-funded: The company receives the exercise price as new capital

Warrants are often issued as "sweeteners" attached to bonds or preferred stock to make the offering more attractive to investors. By adding warrants to a debt offering, companies can reduce the coupon rate they must pay, effectively trading future potential dilution for lower current financing costs.

Because warrant exercise increases the number of shares outstanding, the value of a warrant () is adjusted for dilution compared to a standard call option (). The dilution adjustment recognizes that when warrants are exercised, the total equity value is spread across more shares:

where:

- : number of shares currently outstanding

- : number of warrants issued

- : value of a standard call option (typically calculated using Black-Scholes)

- : dilution factor representing the percentage of the company retained by original shareholders

The intuition behind this formula is straightforward. When warrants are exercised, new shares are created, and the total value of the company is divided among more shares. The dilution factor represents the fraction of the company that will be owned by original shareholders after exercise, which is less than 100% because new shareholders (the warrant holders) will now own part of the company. The following function calculates the warrant value by adjusting the standard Black-Scholes price for this dilution effect:

The dilution discount of 9.1% reflects the economic cost of issuing new shares. Unlike standard options where the share count is fixed, warrant exercise increases the shares outstanding, diluting the value of existing equity. This structural difference makes warrants less valuable than equivalent call options because the warrant holder is effectively sharing the upside with new shareholders that did not exist before exercise.

Key Parameters

The key parameters for warrant valuation are:

- N: Number of shares currently outstanding. Larger share counts reduce the dilution impact.

- M: Number of warrants issued. More warrants create more potential dilution.

- Dilution Factor: The ratio , reflecting the value retained by original shareholders after warrant exercise.

- Exercise Price: The price at which the warrant holder can purchase new shares. Higher exercise prices reduce warrant value.

Preferred Stock

Preferred stock sits between common equity and debt in the capital structure, combining features of both in a way that serves specific needs for both issuers and investors. Preferred shareholders receive fixed dividends before common shareholders but typically don't have voting rights. This structure gives you a more predictable income stream than common stock while giving issuers a way to raise capital without diluting voting control. Key variants include:

- Cumulative preferred: Missed dividends accumulate and must be paid before any common dividends. This feature protects you from temporary cash flow difficulties at the issuing company.

- Convertible preferred: Can be converted into common stock at a specified ratio. This variant combines the income stability of preferred stock with the upside potential of common equity.

- Participating preferred: Receives additional dividends beyond the stated rate if common dividends exceed a threshold. This feature allows preferred holders to share in exceptional company performance.

From a valuation perspective, preferred stock resembles a perpetual bond, with the dividend yield being the key return driver. The present value of a perpetual stream of fixed payments can be calculated as the annual dividend divided by the required yield. However, preferred dividends are not tax-deductible for issuers (unlike bond interest), making them more expensive than debt from the issuer's perspective. This tax disadvantage is offset by the fact that preferred stock does not create the bankruptcy risk that debt does.

Mandatory Convertibles

Mandatory convertibles (also called equity units or PERCS) must convert to common stock at maturity, unlike traditional convertibles where conversion is at your option. The mandatory nature of conversion means these securities are closer to equity than traditional convertibles, with the bondholder certain to receive shares at maturity rather than having the choice. They typically offer higher yields than traditional convertibles but cap the upside:

- If the stock is below a lower threshold at maturity, conversion is at a higher ratio. If above an upper threshold, conversion is at a lower ratio. Between thresholds you receive shares worth par value.

This structure gives you higher income but limits participation in extreme stock price appreciation. The capped upside is the price you pay for the enhanced yield during the holding period.

We can model this payoff structure across a range of stock prices at maturity:

Key Parameters

The key parameters for mandatory convertibles are:

- Par Value: The face value of the security, which determines the value received when the stock price is between the two thresholds.

- Lower Threshold: The stock price below which the conversion ratio is fixed at the maximum level. Below this price, the investor receives a fixed number of shares regardless of how low the stock falls.

- Upper Threshold: The stock price above which the conversion ratio is fixed at the minimum level. Above this price, the investor's upside participation is capped.

Contingent Convertibles (CoCos)

Contingent convertible bonds (CoCos) are hybrid capital instruments primarily issued by banks to meet regulatory capital requirements. Unlike traditional convertibles, conversion is not optional. It is triggered automatically when the issuer's capital ratio falls below a specified threshold. This automatic trigger mechanism means CoCos convert to equity (or are written down) precisely when the issuer is in distress, providing automatic recapitalization when it is most needed.

The key features of CoCos include:

- Trigger mechanism: Based on accounting ratios (like Common Equity Tier 1) or regulatory discretion. The trigger defines when conversion or write-down occurs.

- Loss absorption: Either conversion to equity or principal write-down. The specific mechanism determines what investors receive when the trigger is hit.

- Higher yields: Compensate investors for the forced conversion risk. These yields can be substantially higher than comparable straight debt.

CoCos played a prominent role during the 2023 Credit Suisse crisis, when $17 billion of AT1 CoCos were written down to zero, highlighting the significant risks these instruments carry. This event served as a stark reminder that the enhanced yield on CoCos comes with genuine downside risk that can materialize rapidly in stress situations.

Structured Notes

Structured notes combine a debt obligation with derivative components to create customized payoff profiles. As we discussed in the chapter on Structured Credit Products, financial engineering allows the creation of instruments tailored to specific investor needs. The structured note market has grown substantially as investors seek customized risk-return profiles that are not available through standard securities. Common structures include:

- Principal-protected notes: Bond plus call option that guarantees return of principal with equity upside. These appeal to conservative investors who want equity exposure without principal risk.

- Reverse convertibles: Short put embedded in a note, offering high yield but equity downside exposure. Investors essentially sell downside protection in exchange for enhanced income.

- Autocallables: Early redemption triggered if the underlying exceeds a barrier on observation dates. These structures offer high coupons but may be called away before maturity if the underlying performs well.

These products can be understood by decomposing them into their component parts: a zero-coupon bond for principal protection and various option positions for the return enhancement or equity exposure. This decomposition approach allows you to understand the true risk-return tradeoffs embedded in what might otherwise appear to be complex structures.

Practical Considerations

Understanding convertible bonds from both issuer and investor perspectives clarifies why these instruments exist and how credit risk affects their behavior.

Why Companies Issue Convertibles

Companies choose convertible bonds for several strategic reasons:

Lower coupon cost: The conversion feature is valuable, allowing issuers to pay 2-4% lower coupons than straight debt. For a company with limited cash flow, this reduced interest burden can be significant, preserving cash for operations or growth investments.

Delayed dilution: If management believes the stock is undervalued, a convertible allows future equity issuance at a higher price rather than issuing shares today. This helps companies that need capital but want to avoid selling equity at depressed prices.

Access to capital: Some growth companies may not be able to issue straight debt at reasonable rates but can access the convertible market where equity-oriented investors accept more credit risk. The conversion feature provides compensation for credit risk that would otherwise make the debt unattractive.

Investor base diversification: Convertibles attract different investors than straight equity or debt, potentially broadening the company's investor base. This diversification can improve liquidity and reduce the company's cost of capital over time.

Why Investors Buy Convertibles

From your perspective, convertibles offer several attractive characteristics that are difficult to replicate with other securities:

Asymmetric returns: Participation in equity upside with bond-like downside protection (subject to credit risk). This profile appeals to you if you want equity exposure but cannot tolerate the full volatility of stock ownership.

Yield with growth potential: Higher income than common stock while maintaining equity exposure. This combination is particularly valuable in low interest rate environments where income is scarce.

Risk management: Lower volatility than the underlying stock due to the bond floor. If you have volatility constraints, convertibles can provide equity-like returns with reduced risk.

Convertible arbitrage: Hedge funds often buy convertibles and short the underlying stock, extracting value from the volatility embedded in the conversion option. This strategy involves complex delta hedging that we'll explore further in Part III when we cover option risk management.

Credit Risk Considerations

The bond floor in a convertible is only as good as the issuer's credit quality. If the company approaches financial distress, both the equity and debt components decline together, creating a correlation that reduces the effectiveness of the bond floor protection:

- The stock price falls, reducing conversion value

- Credit spreads widen, pushing down the straight bond value

- In bankruptcy, convertible bondholders are typically senior to equity but may receive significantly less than par

This credit-equity correlation means convertibles offer less downside protection than their structure might suggest, particularly for lower-rated issuers. You should analyze the issuer's credit fundamentals alongside the convertible's equity characteristics. A convertible on a company with weak credit may provide far less protection than the theoretical bond floor suggests.

Limitations and Impact

Convertible bonds and hybrid securities have changed how companies raise capital, but they have important limitations.

Accurate valuation is difficult. While our simple component model provides intuition, real valuation requires models that capture the interaction between credit risk and equity dynamics. When a stock price falls, credit quality typically deteriorates, meaning the bond floor erodes when needed most. This credit-equity correlation is difficult to model and can lead to unexpected losses. The 2008 financial crisis demonstrated this vividly when many "busted" convertibles (those trading well below par with the conversion option deeply out-of-the-money) experienced further declines as credit spreads widened.

The callable nature of most convertibles adds another layer of complexity. Issuers can typically call their convertibles when the stock rises significantly above the conversion price, forcing bondholders to convert and capping their upside. This call feature effectively transfers value from bondholders to the company, as the issuer exercises the call precisely when the embedded option is most valuable. Modeling callable convertibles requires assumptions about the issuer's call policy, adding uncertainty to valuation.

From a market impact perspective, convertible issuance and the associated arbitrage activity can create measurable effects on the underlying stock. When a company announces a convertible offering, the stock often declines as the market anticipates dilution. Convertible arbitrageurs who buy convertibles and short the stock create sustained selling pressure. These dynamics mean convertible issuance decisions have strategic implications beyond simple financing choices.

Despite these limitations, hybrid securities have enabled valuable financial innovation. They provide risk-sharing mechanisms that better align issuer and investor interests, allow companies to access capital markets at different stages of their development, and give you tools to construct portfolios with customized risk-return profiles. The principles underlying convertibles, combining debt protection with equity participation, appear throughout modern finance, from venture capital term sheets to complex structured products.

Summary

This chapter explored convertible bonds and hybrid securities.

The key components of convertible bonds include the conversion ratio (shares received upon conversion), conversion price (effective per-share cost), and conversion value (current worth if converted immediately). Convertible prices are bounded below by the maximum of the straight bond value and conversion value, with additional premium reflecting the option's time value.

Valuation approaches decompose convertibles into their bond and option components, though the interaction between credit risk and equity exposure complicates this analysis. You use metrics like conversion premium, payback period, and delta to analyze and compare convertible investments.

Beyond convertibles, hybrid securities include warrants (company-issued call options subject to dilution), preferred stock (fixed-income-like equity), mandatory convertibles (forced conversion at maturity), CoCos (triggered by capital ratios), and structured notes (customized payoff profiles). Each combines debt, equity, and derivative features in different ways to meet specific issuer and investor objectives.

Understanding hybrids requires integrating fixed income, equity analysis, and derivatives. The pricing models we'll develop in Part III for options and derivatives will provide additional tools for analyzing these complex instruments.

Quiz

Ready to test your understanding? Take this quick quiz to reinforce what you've learned about convertible bonds and hybrid securities.

Comments